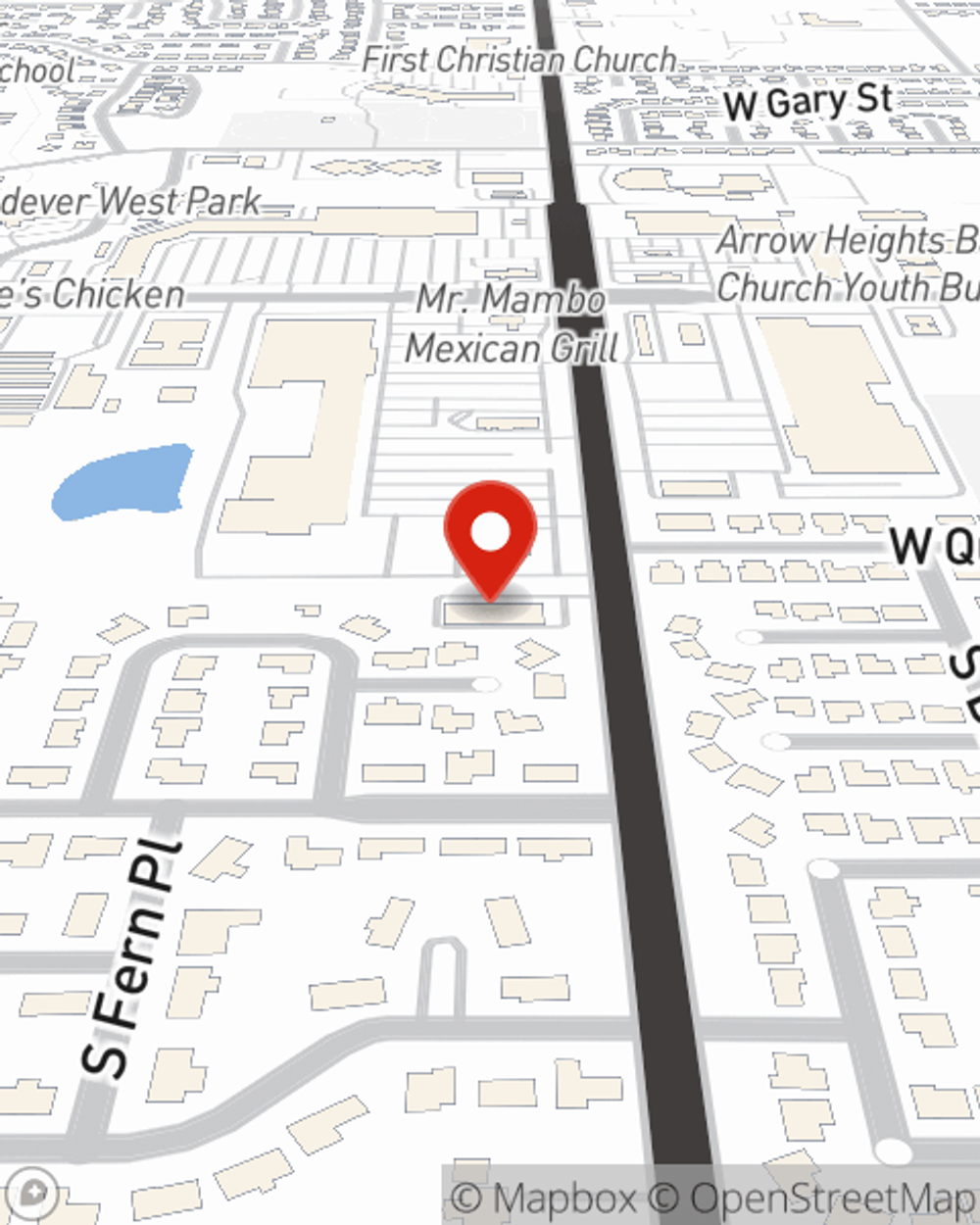

Business Insurance in and around Broken Arrow

One of Broken Arrow’s top choices for small business insurance.

Cover all the bases for your small business

- Broken Arrow

- Tulsa

- Bixby

- Coweta

- Owasso

- Mounds

- Glenpool

- Oklahoma City

- Edmond

- Yukon

- Moore

- Norman

- Sapulpa

- Claremore

- Catoosa

Your Search For Excellent Small Business Insurance Ends Now.

Do you feel overwhelmed when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Jason Strickland help you learn about great business insurance.

One of Broken Arrow’s top choices for small business insurance.

Cover all the bases for your small business

Get Down To Business With State Farm

Did you know that State Farm has been helping small businesses grow since 1935? Business owners like you have turned to State Farm for coverage from countless industries. It doesn't matter if you are a pharmacist or a painter or you own a deli or an art gallery. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Jason Strickland. Jason Strickland is the person who can relate to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to gather more information about your small business insurance options

At State Farm agent Jason Strickland's office, it's our business to help insure yours. Get in touch with our outstanding team to get started today!

Simple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Jason Strickland

State Farm® Insurance AgentSimple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.